Best insurance rates in NC sets the stage for this enthralling narrative, offering readers a glimpse into a story rich in detail, brimming with originality from the outset. In North Carolina, understanding the factors that influence insurance rates, exploring different coverage options, and learning tips for finding the best rates are crucial steps in securing affordable insurance.

As you delve into the intricacies of insurance rates in NC, you’ll uncover valuable insights that can empower you to make informed decisions about your insurance needs.

Overview of Insurance Rates in North Carolina: Best Insurance Rates In Nc

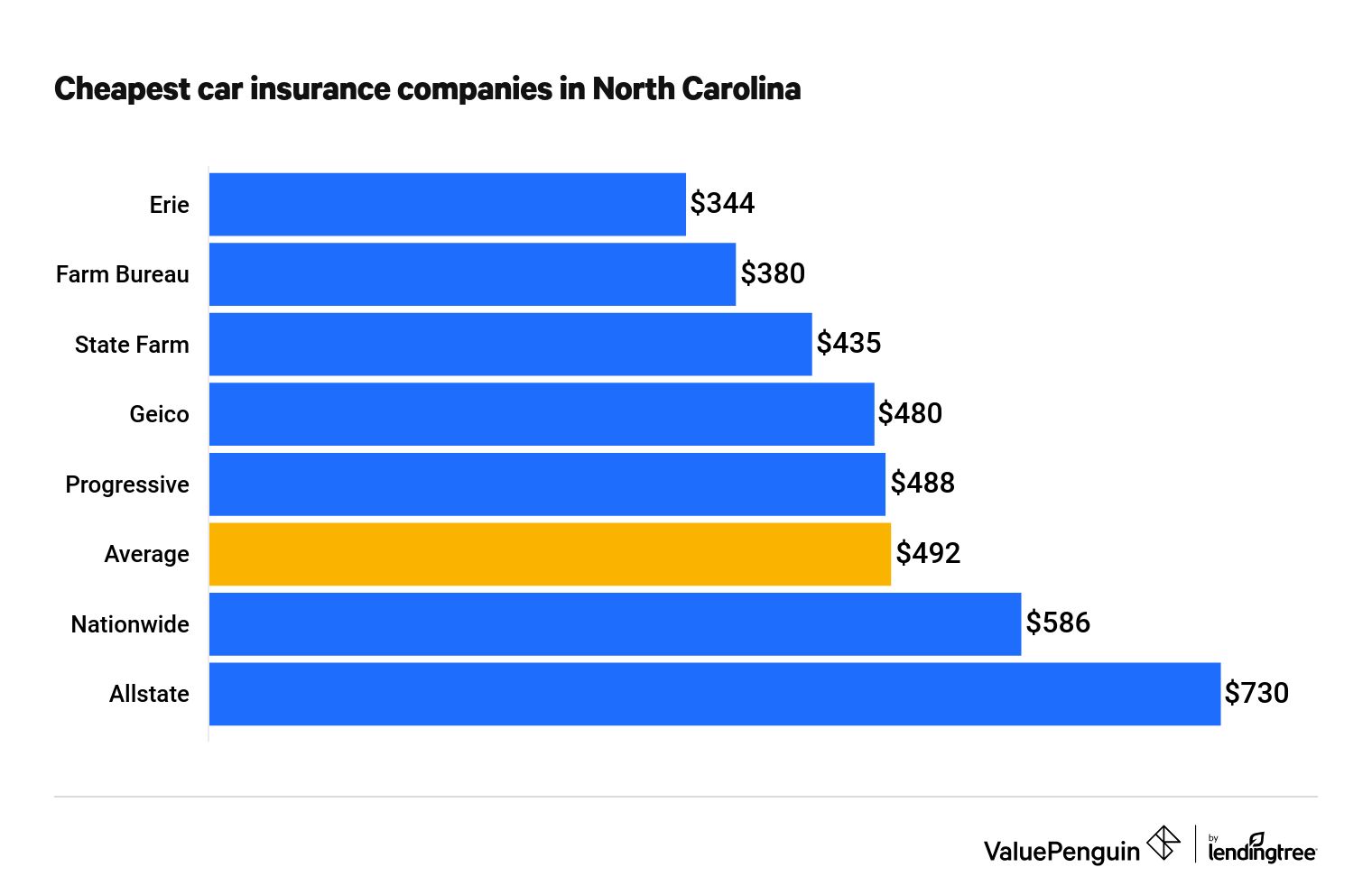

Insurance rates in North Carolina are influenced by various factors such as age, location, driving record, credit score, and the type of coverage needed. Popular insurance companies in the state offering competitive rates include State Farm, GEICO, Progressive, and Allstate. It is essential for consumers to compare quotes from multiple providers to find the best rates that suit their needs.

Types of Insurance Coverage Available in NC

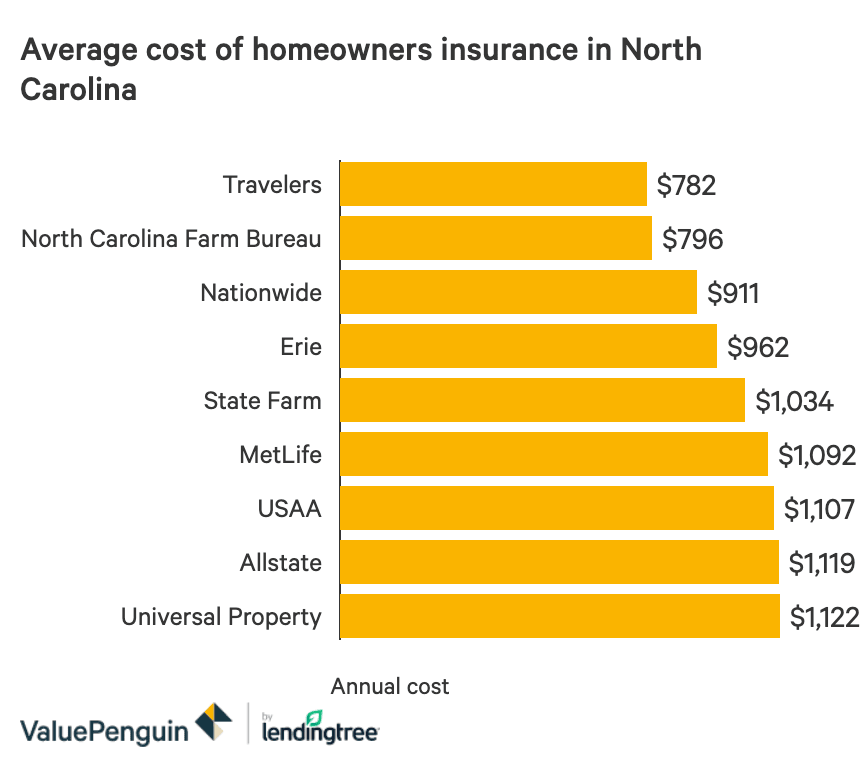

In North Carolina, residents have access to different types of insurance coverage including auto, home, health, and life insurance. Auto insurance is mandatory in the state, while home insurance protects homeowners from property damage. Health insurance provides coverage for medical expenses, and life insurance offers financial protection for loved ones. Some unique insurance offerings specific to North Carolina residents include coverage for hurricanes and flood insurance.

Tips for Finding the Best Insurance Rates

To lower insurance premiums in North Carolina, individuals can consider factors such as bundling policies, maintaining a good credit score, and opting for a higher deductible. Bundling insurance policies with the same provider can result in significant savings, while a good credit score can help in negotiating lower rates. Additionally, comparing quotes from different insurers is crucial to finding the best rates.

Understanding State-Specific Regulations, Best insurance rates in nc

State regulations play a significant role in insurance rates in North Carolina. Laws and regulations affect pricing and coverage requirements, such as the minimum liability coverage for auto insurance. Being aware of these regulations can help consumers navigate the insurance market effectively and find the best rates available.

Closing Summary

Navigating the world of insurance rates in North Carolina can seem complex, but armed with the right knowledge, you can confidently find the best insurance coverage at the most competitive rates. Start your journey towards financial security and peace of mind today.

Frequently Asked Questions

What factors influence insurance rates in NC?

Insurance rates in NC are influenced by factors such as age, driving record, credit score, and the type of coverage desired.

How can I lower my insurance premiums in North Carolina?

To lower your premiums, consider bundling policies, maintaining a good credit score, and comparing quotes from multiple providers.

Are there any unique insurance offerings specific to North Carolina residents?

Some insurance companies in NC may offer specialized coverage options tailored to the needs of residents in the state.