John Hancock Travel Insurance Cancel for Any Reason offers a unique solution for travelers seeking flexibility and peace of mind. Explore the benefits, coverage details, and essential information in this comprehensive guide.

Delve into the specifics of canceling for any reason, understanding the costs involved, and maximizing the advantages of this specialized insurance coverage.

Overview of John Hancock Travel Insurance Cancel for Any Reason

John Hancock Travel Insurance Cancel for Any Reason provides travelers with the flexibility to cancel their trip for any reason and receive reimbursement for a portion of their non-refundable trip expenses. This type of coverage allows travelers to have peace of mind knowing that they can cancel their trip without having to provide a specific reason.

Some benefits of having John Hancock Travel Insurance Cancel for Any Reason include the ability to cancel up to 48 hours before the scheduled departure, coverage for up to 75% of non-refundable trip expenses, and the option to customize coverage based on individual needs.

Having this type of insurance coverage can be beneficial in scenarios such as sudden illness, family emergencies, work-related issues, or simply a change of plans. It provides travelers with the flexibility to cancel their trip without worrying about losing a significant amount of money.

Coverage Details, John hancock travel insurance cancel for any reason

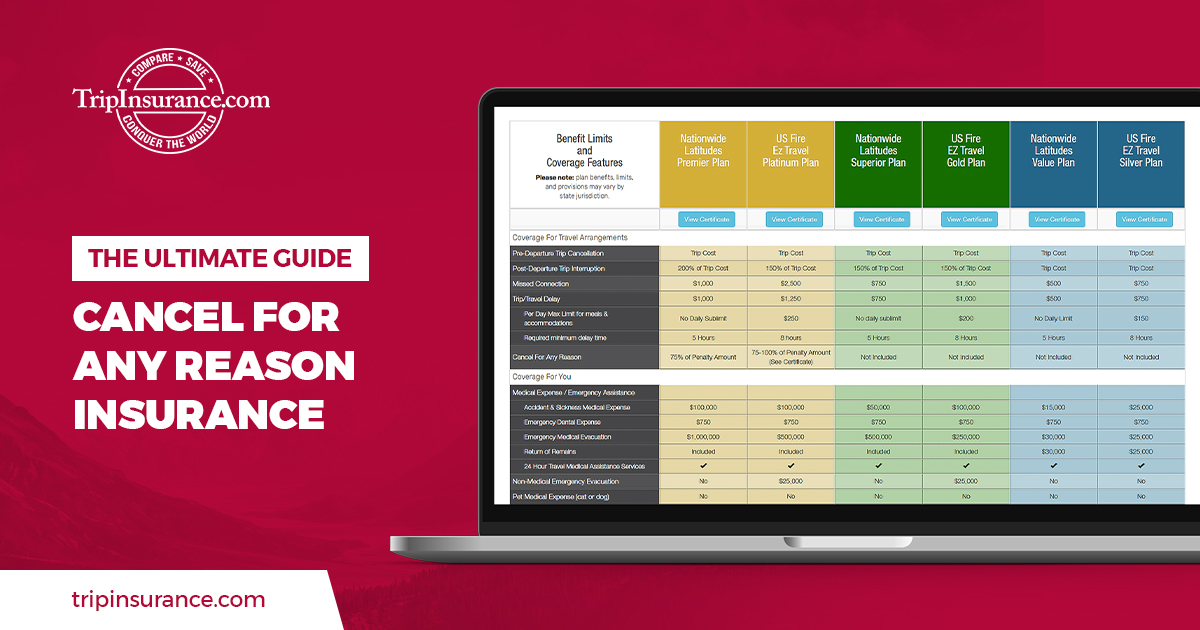

John Hancock Travel Insurance Cancel for Any Reason typically covers up to 75% of non-refundable trip expenses, including airfare, accommodations, and other prepaid travel arrangements. However, it is essential to note that certain limitations and exclusions may apply, such as pre-existing medical conditions or travel arrangements made within a specific timeframe before purchasing the insurance.

When comparing Cancel for Any Reason insurance with standard travel insurance policies, the main difference lies in the flexibility to cancel without providing a specific reason. Standard policies usually require travelers to cancel for specific covered reasons, such as illness, natural disasters, or travel advisories.

How to Cancel for Any Reason

To cancel for any reason with John Hancock Travel Insurance, travelers must notify the insurance provider at least 48 hours before the scheduled departure. They will need to fill out a claim form, provide documentation supporting the reason for cancellation, and submit it for review. Examples of required documentation may include medical records, death certificates, or proof of employment-related issues.

Cost and Considerations

Adding Cancel for Any Reason coverage to a travel insurance policy may increase the overall cost of the insurance. Travelers should consider factors such as the cost of the trip, the likelihood of needing to cancel, and the level of coverage required before opting for this additional coverage.

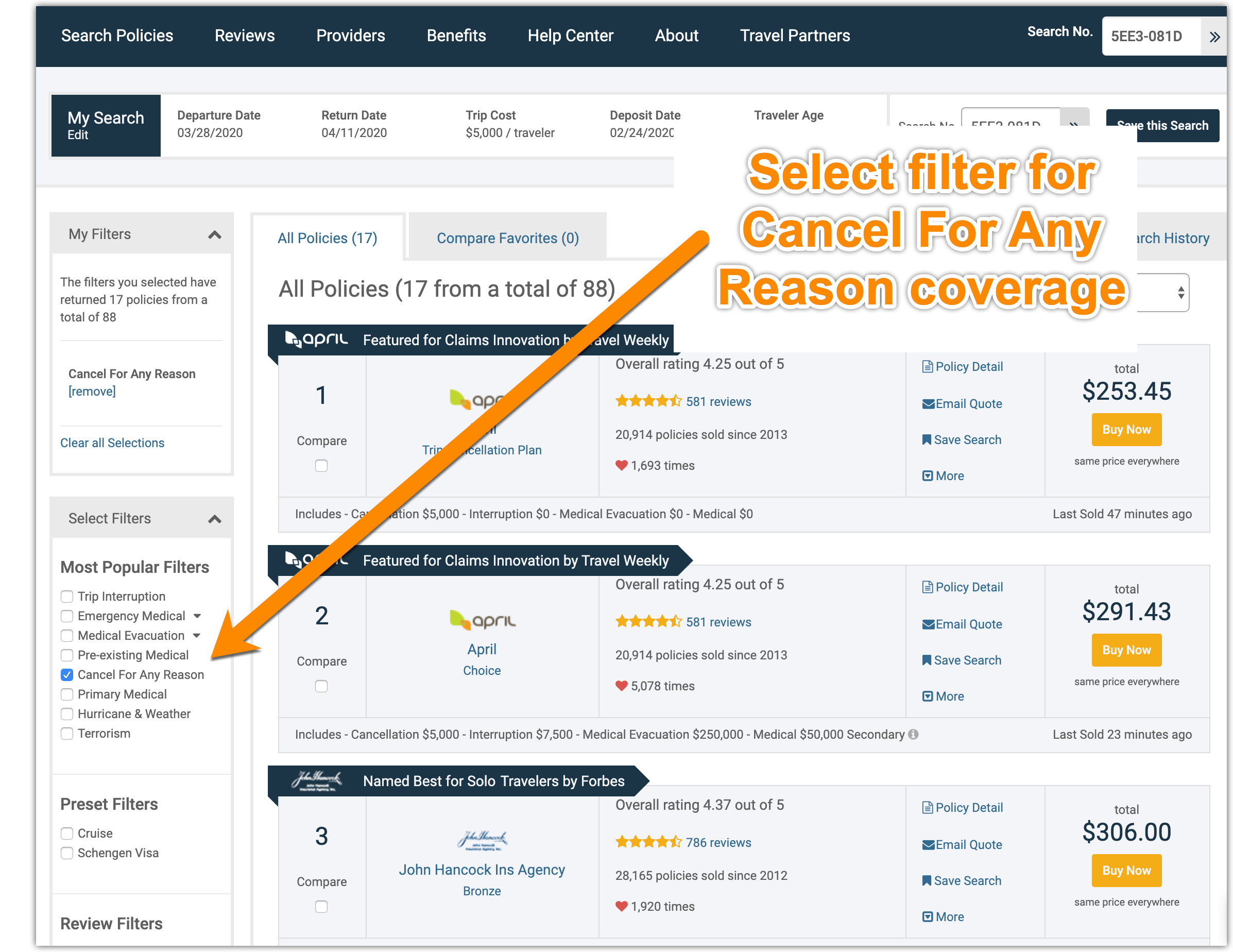

To maximize the benefits of Cancel for Any Reason insurance, travelers should carefully read the policy terms and conditions, understand the coverage limits and exclusions, and keep all necessary documentation in case of cancellation. It is essential to weigh the cost of the coverage against the potential benefits and peace of mind it provides.

Conclusive Thoughts

In conclusion, John Hancock Travel Insurance Cancel for Any Reason provides a safety net for unexpected travel changes, ensuring a stress-free journey. Make informed decisions and enjoy your travels with added confidence.

Common Queries: John Hancock Travel Insurance Cancel For Any Reason

What does John Hancock Travel Insurance Cancel for Any Reason cover?

John Hancock Travel Insurance Cancel for Any Reason typically covers unforeseen circumstances that are not included in standard insurance policies, allowing travelers to cancel for any reason.

How does one file a claim for cancellation with John Hancock Travel Insurance?

Travelers can initiate the claim process by contacting the insurance provider, submitting the necessary documentation, and following the Artikeld procedures for cancellation.

Is there a limit on the number of cancellations allowed with John Hancock Travel Insurance Cancel for Any Reason?

There may be restrictions on the frequency of cancellations under this coverage, so it’s advisable to review the policy details carefully.

Are pre-existing medical conditions covered under Cancel for Any Reason insurance?

Pre-existing medical conditions are typically not covered under Cancel for Any Reason insurance, so it’s important to understand the limitations of the policy.

Can Cancel for Any Reason insurance be added to an existing travel insurance policy?

Yes, travelers can usually add Cancel for Any Reason coverage as an additional option to their existing travel insurance policy for enhanced protection.